Well, darlings, it’s high time we address the question lingering in the air for far too long: Who should really be in control of money? And by the end of this exposé, we shall arrive at the inevitable answer – women, of course! Money Management in a FLR is one of the critical elements of a woman’s control – Let’s dive into the fabulous reasons why, shall we?

Money Management in a FLR: why women should be in charge of the money

- Emotional Intelligence: Contrary to popular belief that emotions can disadvantage the financial world, emotional intelligence is paramount when making sound monetary decisions. It isn’t just about knowing when to invest but also when to pull out, which requires an intrinsic understanding of people. And who better to read people than women? We’re practically psychic!

- We’re Prudent, Not Pompous: Did you know that studies have found that women are less likely to take high risks in investment scenarios than men? That means we’re less likely to bet it all on black and lose the house. Instead, we make informed, cautious choices that are more sustainable in the long run. There’s something to be said about playing the long game.

3. Multitasking Maestros: Juggling housework, careers, children, and still looking fabulous? If anyone can balance a budget, juggle multiple financial commitments, and still ensure there’s money left for that spontaneous shopping spree, it’s women.

4. Nurturing Nature: Women, by nature, are caregivers. This is not just a stereotype but a biological imperative. If women control the money, there would be more investment in healthcare, education, and social causes. Less guns, more butter. Isn’t it a sweet thought?

5. Less Ego, More Empathy: Financial crises are often a result of inflated egos making reckless choices. Women, on the other hand, tend to prioritise collective well-being over personal glory. Meaning fewer financial disasters and more cooperation.

6. Less Likely to Fall for Peer Pressure: Remember high school? Men can be swayed by the “big boys” at the golf course pushing the “next big thing.” Women, however, are often more discerning, thinking several steps ahead and considering the wider implications.

7. The Proven Track Record: Let’s not forget that numerous women have graced the financial industry with their prowess – think Abigail Johnson of Fidelity or Mary Callahan Erdoes of J.P. Morgan. These powerhouses have proven that when women are in charge of finances, they’re not just good; they’re exceptional.

Money Management in a FLR: Ideas for micromanaging his spending:

Set a spending limit: set a low limit for spending, say $100; anything above this, he has to seek your permission, ideally whilst kneeling. With a limited allowance, there’s an inevitable increase in dependency. This can lead to more regular conversations, increasing bonding and ensuring he checks in before making significant financial decisions.

- Track spending – Host a weekly receipt show-and-tell. Let him present his spending like a kid showing off school artwork. And just like art, some choices may be… questionable. Time for some constructive criticism! In a society that often equates financial prowess with power, receiving a limited allowance and justifying his spending can be a grounding experience for the man, teaching humility and gratitude.

- The Approved List: Create a list of pre-approved shopping destinations. Did he just wander into a store that was not on the list? Alert the fashion police, because that’s a crime against your financial plan.

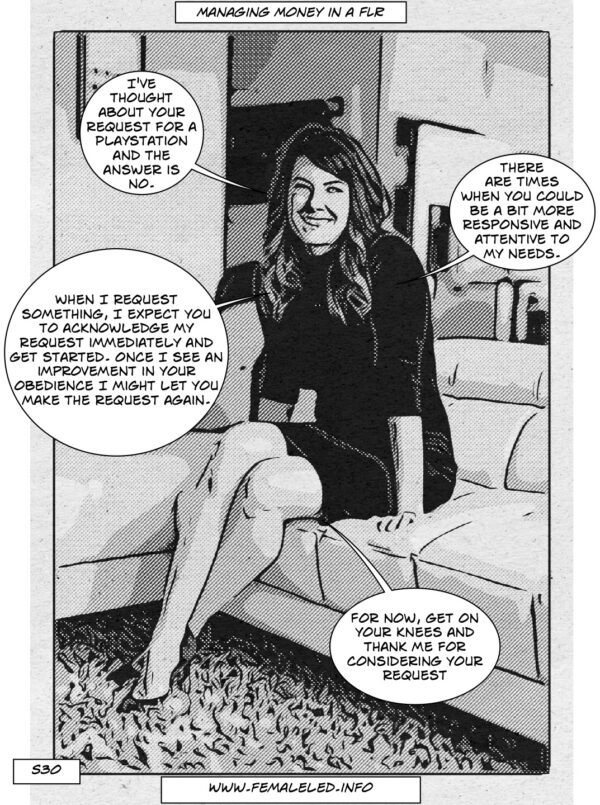

- Control the accounts and card– Maintain control over the credit cards. Let him have one with a minimal limit for emergencies. Oh, and sweetie, that new PlayStation? NOT an emergency.

- Making him beg to spend his money – Start by instilling the idea that spending is a privilege rather than a right. Over time, this perspective shift can turn the act of spending into something more tantalisingly out of reach. Make him wait a little. Not too long, just enough to increase his anticipation. When he asks for permission, a simple “I’ll think about it” can do wonders.

- Direct his salary to your account – see below

Money Management in a FLR: Navigating Salary Transfers in a FLR

Ah, the ultimate power move in a FLR! Diverting his paycheck into her account is not just about financial control; it’s about trust, respect, and partnership. But how does a modern queen approach this without causing undue stress or feeling overbearingly domineering? Pour a glass of your finest wine, and let’s dissect this delicate operation.

1. Laying the Groundwork: Before any financial decisions are made, it’s imperative to discuss the why’s and how’s. Make sure he understands that this isn’t about deprivation, but organization and smarter financial management.

2. The Mutual Benefits: Frame the conversation around mutual benefits. This isn’t just a power play; it can be a way to manage finances better, save for mutual goals, and ensure a more prosperous shared future.

3. Allocation Allowance: While his salary might be transferred to your account, ensure he has an “allowance” or “budget” for personal expenses. This ensures he doesn’t feel completely financially stifled.

4. Transparency is Key: Give him access to view the account or provide regular financial statements. It ensures trust is maintained and he knows where the money is being allocated.

5. The Gentle Reminder: While this may seem like a role-reversal from traditional dynamics, always remind him that it’s the trust he places in you that makes this work. It’s not just about money; it’s a symbol of his confidence in your joint direction.

6. Joint Financial Goals: Ensure that you both set financial objectives together. Be it that dream vacation in Bora Bora or that swanky new car, setting and achieving goals together makes the entire arrangement more fulfilling.

7. Emergency Protocol: Set up a system where he can access funds for emergencies without delay. It’s crucial to remember that while you’re overseeing the finances, practicality in emergencies remains paramount.

Redirecting his salary into your account is not just a mere transaction; it’s a representation of the dynamics of your relationship. Like all things in a FLR, it’s built on mutual respect, trust, and shared goals. So, toast to your shared financial future and the unique path you’ve chosen.

So, why should women be in charge of money? Because it’s in everyone’s best interest. And to those sceptical men out there, don’t fret! By placing women at the helm of finance, we’re not excluding you; we’re simply setting you free from the chains of fiscal responsibility. You can thank us later – we prefer chocolates and roses.

Early on in Our/our relationship, i suggested to my Goddess that We/we set up a joint bank account. i’ll never forget the incredulous look She gave me before dismissing the suggestion out of hand. Over time She has taken full control of the finances just as much as She has taken full control of everything in Our/our relationship. Only She has access to the banking and investment accounts. i never even see the screen when She is doing banking and i have no idea how much money is in the accounts. i still have a modest vestigial bank account, the remnants of my time before i became ‘kept’ by Her. She has access to that account and i have to seek Her permission before i make any transactions with it. She will occasionally pick my brain about financial matters (one of my weekly tasks is to follow the markets / financial / business news and provide Her with a summary of the week which might suggest some investment opportunities. All the actual decisions are made by Her exclusively. All of which is a good thing. i’m astonished when She does tell me just how much wealth She has been able to build. i know there is no way i would have had the financial smarts/discipline to do it. As for day to day things like shopping She gives me one of Her credit cards to shop with and it is explicitly Her credit card, Her name is on it and it’s linked to Her account. Every time i use it i’m reminded that it’s Her money that is being spent. It’s a little routine humiliation and i’m sure it’s meant to be just that. It’s a power thing i know, and i fully submit to that.

Have the inferior male transfer his earnings to the Superior Female. Give the inferior male an allowance and make him beg to spend money.

It is only fitting that the Superior Female controls the purse strings, just as she has the inferior male tied tightly to her apron strings!

Great article, Cat!

Years ago, (3/10/79) when we married, we each had a separate bank account, but when banks began imposing monthly maintenance fees, we used her credit union account as our joint account. I earned a third of our combined income. She was an art teacher, I was a fork truck operator. Even today, old style banking customs being what they are, I still do not appreciate that her account has to be in the husband’s name! It was her account: she opened it while she was still in college. We just used it as our one account.

I do let her handle all our money. She does a much more thorough job handling our finances than I even want to.

Wife sets policy and i see it through, in social, sexual, domestic and financial areas. For example, She may decide the pattern of a particular flooring for an upgrade to the living room and when the bill comes due, i see that it gets paid on time. But before She makes that purchase, She has decided it is necessary, the type of flooring is appropriate and how much to spend. She will give Her the answers to the research that goes into each decision and i am expected to offer advice when asked. It only seems natural to me, and, eventually to the salesperson who always start out trying to get my commitment but end up making any deal by speaking exclusively to Her. In this article, the only thing i could not relate to, was that husband could spend $100 without checking first. In setting the budget, Wife has decided that She and i should get some spending money. She gets three times what i get, but even though i get $50 for my allowance, there is no way i would ever spend more than a buck or two without checking with Her first. It’s not domething She ever said anything about, it’s solely me appreciating Her guidance